Trust-Enhancer Pre-Merge&Acquisition Services

>>Other Services in Taiwan

>>Services in other China Cities

Prerequisites before a local China company being merged or acquired;

Implement Cloud Accounting System to set up collaboration working Environments;

Online Accountant remote Services for 3-6 months;

Preview each transactions through Cloud System;

Ensure your financial statement in good quality.

Service Coverage

Our Trust-EnhanserRPre-Merge&Acquisition Services includes:

Implement Cloud Accounting and Payroll system to set up collaboration working environments

Payroll Cycle–leave, Shift, Payroll Calculation, insurance, Pension fund, Pay slip

Expenditure—Employee expenses, Office expenses, Travel expenses

Services for Receiving Cycle — from order to cash

Services for Payment Cycle — from purchase to payment

Services for General Ledger — from record to report

Services for VAT filing

Services for Cost Accounting

Online Accountant remote Services.

When will you need our Trust-EnhancerR Pre-Merge&Acquisition Services?

Start up new JV with local China Partner

6 months before merging an existing Chinese local enterprise

Following the merging of an existing Chinese local enterprise

If you want to penetrate the Chinese market, you might consider merging with existing local Chinese enterprises.

However this is made unfeasible due to numerous risk issues.

Why does merging with a local company in China involve high legal or tax risks?

Local companies in China have a so-called two-book issue.

One book refers to the one shown to the Tax Bureau, which reflects little income, the other is shown to shareholders which reflect real income figures, which is higher than that shown to the Tax Bureau.

This practice presents very high tax risks, because the total tax rate will reach approximately 49% of the earned income if a company is to be totally open with its figures.

It is easier for a WFOE company to keep one book only because it can arrange for its earned income to be kept overseas although China has adopted Transfer Pricing measures.

It might therefore be the best option to establish a new WFOE or Joint venture company with your local partner in China.

In this scenario, you should use our Trust-EnhancerR online ACCOUNTANT remote services from start-up in order to guarantee your China JV be compliant with relevant regulations.

However, should you still want to merge with existing local Chinese companies, assigning only a famous CPA company to perform due diligence will not suffice.

It is better to ask the merged entity in China to use our Trust-EnhancerR Pre-Merge&Acquisition Services first for at least 6 months, then your staff in the parent company can jointly review every single transaction through our Evershine Cloud System.

You can then evaluate as to how much risk you are to undertake when merging.

How do we help your Asia Company to be compliant with local regulations?

We will act as your in-house accountant using our web-platform system to create a collaborative working environment, which allows us to perform tasks just like an in-house accountant would when recruited by you.

Evershine staff will review every transaction via the cloud system in our own office and see if these are compliant with regulations. Evershine staff will go to your JV Company and provide consultation when necessary.

Since staff of the Parent company can jointly review or approve every transaction through our Cloud System, your WFOE in Asia need not recruit any local accountant, treasury, payroll handler and IT personnel when adopting our services.

We provide Trust-EnhancerR online ACCOUNTANT remote services for WFOEs in Taiwan, Beijing, Xiamen, Shanghai, Guangzhou, other areas in China, California, or Tokyo. The online ACCOUNTANT remote service means that we can undertake four functions including Accounting and Tax Compliance, Treasury and web-banking maker, Payroll compliance, and Cloud System provider. WFOE is the acronym of Wholly Foreign Owned Enterprises.

Features of Trust-EnhancerR online ACCOUNTANT remote service

The parent company ACCOUNTANT or his/her assigning staff approves payment request(s) and the money wiring processes through an enterprise web-banking function with three-level authorization.

Fraud-proof, Seamless collaboration, Hassle-free are our service features.

Contact us:

Please notify us by email should you be interested in our Trust-EnhancerR Pre-Merge&Acquisition Services:

Contact Us:

sel2tw@evershinecpa.com : Taiwan Area

sel2cn.south@evershinecpa.com : Xiamen

sel2cn.north@evershinecpa.com : Beijing

sel2cn.east@evershinecpa.com : Shanghai

Sales.Nanjing@evershinecpa.com: Nanjing

Sales.Hangzhou@evershinecpa.com: Hangzhou

Headquarter@evershinecpa.com : The cities of China other area

Responses generally takes app. 1-2 working days.

For you information:

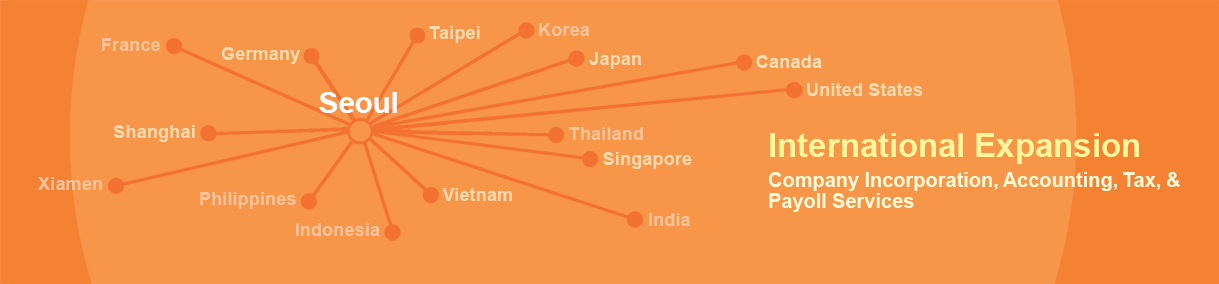

Evershine has its 100% owned office to provide you services in below cities:

Taipei, Beijing, Shanghai, and Xiamen

We have been providing our services with our so-serving partners in below cities:

Kaohsiung Taiwan, Singapore, Hong Kong, Tokyo Japan, Hangzhou China,

Nanjing China, Guangzhou China, Kuala Lumpur Malaysia

As for other cities where we can arrange co-serving partners,

please click below two linking to find it out.

IAPA Find out Member Firm of IAPA

and LEA Find out Member Firm of LEA

These are associate members of Evershine in the world

we have about 9+00 firms with employee number 38,000 in about 450 cities.

Once your firms are located in the above cities, we can serve you.

Please contact us by HQ4sel@evershinecpa.com