Country-by-Country Online Knowledge Database ww2ww

We have built County-by-country online Knowledge Database based on Main Topics as below:

The Main Topics are relevant to those must-know issues when a Multi-National-Entity (MNC) expands overseas entities.

We use County-by-country online Knowledge Database to sharing and training Evershine staff and local partner staff.

It really is helpful for assuring our clients being compliance with tax, payroll, and investment regulations in each country.

ELR-MT-WW

Legal Services and Company Registration

ELS-MT-WW

Special Permit Industry

ELI-MT-WW

Initialize your Business

ELW-MT-WW

Work Permit, Visa, Resident Certificate

ELP-MT-WW

Payroll and Labor Compliance

ELE-MT-WW

Non-Payroll Income Tax-Withholding Mechanism

ELB-MT-WW

Operation: Selling Cycle, Purchase Cycle, Inventory cycle

ELV-MT-WW

VAT & GST

ELA-MT-WW

Corporate Income Tax Compliance

GTX-MT-WW

Global Tax

***

ELR-MT-WW

Legal Services and Company Registration

ELR-MT-WW-10

Subsidiary,Company,Branch,Representative Office

ELR-MT-WW-20

Special Permission Industry, Prohibited Industry, Restricted industry, Positive List, Negative list

Minimum Capital; Foreign capital VS Local capital Ratio

ELR-MT-WW-30

Incorporator,Shareholders,Directors,Company Secretary VS nominee

How long Incorporators’ shares can be sold after being set up.

Nominee VS Updated Transfer Agreement VS Company Secretary

ELR-MT-WW-40

Virtual Register Address VS Operating Address VS One address one company?

ELR-MT-WW-30

Work Permit, Visa, Resident Certificate

Minimum Salary; Minimum Capital; Minimum Annual Turnover

ELR-MT-WW-50

Notarization and Authentication? General Procedures?

ELR-MT-WW-60

Foreigners Investment Review Committee; Investment Committee, Commercial Committee; Security Exchange committee;

ELR-MT-WW-70

Company License and ID number

ELR-MT-WW-80

Tax ID; National Income Tax ID; Local Income Tax ID

***

ELS-MT-WW

Special Permit Industry

ELS-MT-WW-10

Prohibited Business Items; Positive-List Business Items; Negative-List Business Items

ELS-MT-WW-20

Special Permission Industry, Prohibited Industry, Restricted Industry, Positive List, Negative list

Minimum Capital; Foreign capital VS Local capital Ratio

ELS-MT-WW-30

Avoid special permit industry

ELS-MT-WW-40

特許行業批准證書申辦;食品流通許可證,醫療器材銷售許可證,藥證,海空貨物承攬業等

Special Industry Permit Application

***

ELI-MT-WW

開業前準備工作

Initialize your Business

ELI-MT-WW-10

稅務證號; 國稅局註冊號碼; 地方稅局註冊號碼;

Tax ID; National Income Tax ID; Local Income Tax ID

ELI-MT-WW-20

營業稅稅務號碼

VAT or GST Tax ID

ELI-MT-WW-30

網路外商銀行, 在地銀行, 代收代付服務

Open Bank Account, Internet Banking Account opening; Foreigners-owned Bank; Local Bank; Money movement Services

ELI-MT-WW-40

員工福利證號;社會保險證號;醫療保險證號;退休金證號;

Employee Benefit ID; Social insurance ID; Medical Insurance ID; Pension Fund ID

ELI-MT-WW-50

勞動管理當局證號

Labor Bureau ID

ELI-MT-WW-60

進出口證號

Importer and Exporter ID

***

ELW-MT-WW

工作證,簽證,居留證

Work Permit, Visa, Resident Certificate

ELW-MT-WW-10

工作證,簽證,居留證 與 薪資,資本額﹐營業額關係

Work Permit, Visa, Resident Certificate

Minimum Salary; Minimum Capital; Minimum Annual Turnover

ELW-MT-WW-20

文件認證;投資國證件公證;投資國駐外單位認證

Documents Certified; Authorization from Investor’s country; Authentication from Investee’s country.

ELW-MT-WW-30

派駐人員;工作證申請;工作Visa 申請;居民證申請;住房補貼;定期回國休假;個人所得稅

Expatriate; Work Permit, Visa, Resident Certificate; Housing Compensation; Periodically Back to Parent company; Individual Income Tax

ELW-MT-WW-40

派駐人員眷屬及其子女教育問題

Dependents of Expatriates and Education Their Children

***

ELP-MT-WW

薪資與勞動

Payroll and Labor Compliance

ELP-MT-WW-10

Gross To Net 的意義

ELP-MT-WW-20

勞動保險,健康保險,勞工退休金, 二代健保

Labor Insurance(LI),Medical Insurance(MI),Pension Fund (PF),2G-MI

ELP-MT-WW-30

薪資扣繳

Payroll withholding Tax (PWT),PAYE,TDS

ELP-MT-WW-40

薪資扣繳的課徵機制

何時申報 (讓政府知道細節)?

有電子申報機制嗎?

何時付款 (透過銀行付到政府帳戶)?

預存並自動滑款機制?

Payment Mechanism of Payroll WT

When to file (Let Government know)?

Electronic Filing Mechanism?

When to pay (Pay to government account through Bank)?

In-advance deposit mechanism?

ELP-MT-WW-50

勞保、健保、勞退的課徵機制?

何時申報 (讓政府知道細節)?

有電子申報機制嗎?

何時付款 (透過銀行付到政府帳戶)?

預存並自動滑款機制?

Payment Mechanism of LI,MI,PF,2G-MI

When to file (Let Government know)?

Electronic Filing Mechanism?

When to pay (Pay to government account through Bank)?

In-advance deposit mechanism?

ELP-MT-WW-60

勞基法,各種假別 :年休,病假,喪假,事假,婚假等

Labor Law, Leave-type, Annual Leave, Illness Leave, Funeral Leave, Personal Leave Marriage Leave etc.

ELP-MT-WW-70

加班費率, 加班工時限制, 一例一休

Overtime Rate, Overtime Limit, one fixed day off, and one flexible rest day.

ELP-MT-WW-80

代收代付服務—薪資相關

Money Movement Services for Payroll

ELP-MT-WW-90

個人所得稅年度申報

何時申報 (讓政府知道細節)?

有電子申報機制嗎?

何時付款 (透過銀行付到政府帳戶)?

預存並自動滑款機制?

Annual Individual Corporate Tax filing

When to file (Let Government know)?

Electronic Filing Mechanism?

When to pay (Pay to government account through Bank)?

In-advance deposit mechanism?

ELP-MT-WW-A0

非稅務居民 -個人所得稅扣繳

何時申報 (讓政府知道細節)?

有電子申報機制嗎?

何時付款 (透過銀行付到政府帳戶)?

預存並自動滑款機制?

Non- Resident Withholding Individual Income Tax

When to file (Let Government know)?

Electronic Filing Mechanism?

When to pay (Pay to government account through Bank)?

In-advance deposit mechanism?

***

ELE-MT-WW

非薪資所得稅–就源扣繳機制

Non-Payroll Income Tax-Withholding Mechanism

ELE-MT-WW-10

非薪資個人所得稅的課徵機制為何?

何時申報 (讓政府知道細節)?

有電子申報機制嗎?

何時付款 (透過銀行付到政府帳戶)?

預存並自動滑款機制?

扣繳與個人所得稅年度申報意義?

Payment Mechanism of Non-salary Individual Income Tax?

When to file (Let Government know)?

Electronic Filing Mechanism?

When to pay (Pay to government account through Bank)?

In-advance deposit mechanism?

Withholding Tax + Annual Individual Corporate Tax filing

ELE-MT-WW-20

非薪資各類所得申報的意義為何?

Annual withholding non-salary Tax Filing?

ELE-MT-WW-30

扣繳與暫繳的差別?

TDS, PAYE, Withholding Tax Vs Provisional Corporate Income Tax?

ELE-MT-WW-30

股利, 支付國內扣繳, 支付國外扣繳,

Dividend, withhold tax when paying to the resident tax-payer entity; Withhold tax when paying to the non-resident tax-payer entity

ELE-MT-WW-40

權利金, 支付國內扣繳, 支付國外扣繳,

Royalty, withhold tax when paying to the resident tax-payer entity; Withhold tax when paying to the non-resident tax-payer entity

ELE-MT-WW-50

服務費, 支付國內扣繳, 支付國外扣繳,

Service fee, withhold tax when paying to the resident tax-payer entity; withhold tax when paying to the non-resident tax-payer entity

ELE-MT-WW-60

利息, 支付國內扣繳, 支付國外扣繳,

Service fee, withhold tax when paying to the resident tax-payer entity; withhold tax when paying to the non-resident tax-payer entity

ELE-MT-WW-70

代收代付服務—會計出納

Money Movement Services for Tax Bureau

***

ELB-MT-WW

作業系統:銷售循環, 採購循環, 存貨循環

Business Operation System: Selling Cycle, Purchase Cycle, Inventory cycle

ELB-MT-WW-10

雲端系統: Cloud System:

搜集資料; 處理資料;使用資料;呈現資料

搜集資料: 資訊發生人在資訊發生時, 資訊發生地要輸入資料

處理資料: 不重復輸入; Download and then upload; DMZ;

使用資料: 永輝用來準備File and Pay 員工,廠商,稅局,勞保局健保局等呈現資料: 結果回傳並查詢

***

TRD-MT-WW-20

使用永輝進銷存系統-貿易業

銷售循環, 採購循環, 存貨循環皆用永輝系統

Use Evershine BIZ –Trading Industry & Project Based Industry

Selling Cycle, Purchase Cycle, Inventory cycle, All use Evershine Cloud System

***

PJT-MT-WW-30

使用永輝專案系統-專案行業

專案銷售循環, 專案採購循環, 專案存貨循環皆用永輝系統

Use Evershine BIZ –Project Based Industry

Project Selling Cycle, Project Purchase Cycle, Project Inventory cycle, all use Evershine Cloud System

***

REL-MT-WW-40

餐廳 POS,零售POS

銷售循環用客戶系統, 從POS 下載並上載至永輝雲端系統

採購循環, 存貨循環在承認應付帳款之前用客戶系統

A/P付款, 存貨成本計算及存貨盤點由永輝執行

Restaurant and Retailing industry with Front-end POS

Selling cycle: Download from Client’s POSE and upload to Evershine Cloud System daily

Purchase Cycle: before recognizing A/P, use Client POSE

Inventory cycle: Use POSE

A/P Pay-out, Inventory Costing, and Physical Inventory; Done by Evershine

ECB-MT-WW-30

電子商務APP, 直銷ERP

銷售循環用客戶系統, 從APP or ERP 下載並上載至永輝雲端系統

採購循環, 存貨循環在承認應付帳款之前用客戶系統

存貨成本及存貨由永輝執行

Restaurant and Retailing industry with Front-end APP or ERP

Selling cycle: Download from Client’s APP or ERP and upload to Evershine Cloud System daily

Purchase Cycle: before recognizing A/P, use Client POSE

Inventory cycle: Use APP or ERP

A/P Pay-out, Inventory Costing, and Physical Inventory; Done By Evershine

***

ECS-MT-WW-30

Electronic Commercial Service industry (ECS)

電子商務APP or ERP

銷售循環用客戶系統, 從APP or ERP 下載並上載至永輝雲端系統

合作夥伴支出循環,在承認應付帳款之前用客戶系統

支出永輝執行

Selling cycle: Download from Client’s APP or ERP and upload to Evershine Cloud System daily

Partners’ being-paid Cycle: before recognize A/P, use Clients’ APP or ERP

Paying-out through bank will be done by Evershine

***

SVC-MT-WW-30

General Service industry (SVC)

銷售循環用永輝雲端系統

支出循環用永輝雲端系統

支出永輝執行

Selling cycle use Evershine Cloud System

Expense Cycle use Evershine Cloud System

Paying-out through bank will be done by Evershine

***

CPC-MT-WW-30

Cost-plus Charge services B2B (CPC)

專業人員出差及工時申報系統使用永輝

Travel expenses and working-hours workflow cycle use Evershine cloud system

***

ELV-MT-WW

營業加值稅 & 營業稅

VAT & GST

ELV-MT-WW-10

營業稅與營利事業所得稅之差別?

VAT or GST VS Corporate Income Tax

ELV-MT-WW-20

營業加值稅 & 營業稅 的不同? 各國稅率?

What are the differences between VAT & GST? Tax Rate in different countries?

ELV-MT-WW-30

營業稅的課徵機制為何? VAT VS GST?

何時申報 (讓政府知道細節)?

有電子申報機制嗎?

何時付款 (透過銀行付到政府帳戶)?

預存並自動滑款機制?

營業稅暫繳與營業稅申報

Payment Mechanism of VAT or GST? VAT V GST?

When to file (Let Government know)?

Electronic Filing Mechanism?

When to pay (Pay to government account through Bank)?

In-advance deposit mechanism?

VAT Provisional and Filing

ELV-MT-WW-40

代收代付服務—營業加值稅 & 營業稅

Money Movement Services for VAT or GST Tax Bureau

ELV-MT-WW-50

各級政府間的營業加值稅退稅機制及其限制

VAT Refund mechanism among different-level government and its limit

***

ELA-MT-WW

公司所得稅

Corporate Income Tax Compliance

ELA-MT-WW-10

營業稅與營利事業所得稅之差別?

VAT or GST VS Corporate Income Tax

ELA-MT-WW-20

所得稅 VS 營利事業所得稅VS 個人所得稅之差別?

Income Tax VS Corporate Income Tax VS Individual Income Tax

ELA-MT-WW-30

營利事業所得稅的課徵機制為何?

何時申報 (讓政府知道細節)?

有電子申報機制嗎?

何時付款 (透過銀行付到政府帳戶)?

預存並自動滑款機制?

暫繳與營利事業所得稅年度申報意義?

Payment Mechanism of corporate Income Tax?

When to file (Let Government know)?

Electronic Filing Mechanism?

When to pay (Pay to government account through Bank)?

In-advance deposit mechanism?

Provisional Corporate income tax + Annual Tax Filing?

ELA-MT-WW-40

扣繳與暫繳的差別?

TDS, PAYE, Withholding Tax Vs Provisional Corporate Income Tax?

ELA-MT-WW-50

營利事業所得稅年度申報,會計帳務處理, 財務簽證,稅務簽證

Annual Corporate Tax filing, Accounting, and Bookkeeping, Statutory Audit; Tax Audit

ELA-MT-WW-60

印花稅;

Stamp Tax

ELA-MT-WW-70

代收代付服務—會計出納

Money Movement Services for Tax Bureau, Venders, and Employees’ expenses

***

GTX-MT-WW

國際租稅

Global Tax

GTX-MT-WW-10

常設機構

Permanent Establishment

GTX-MT-WW-20

租稅協定

Tax Treaty

GTX-MT-WW-30

移轉計價

Transfer Pricing

GTX-MT-WW-40

跨國電子商務稅務

Tax for Cross-border Electrical Commerce

GTX-MT-WW-50

股利,支付國外扣繳,

Dividend, Withhold tax paying to non-resident tax-payer entity

GTX-MT-WW-60

權利金, 支付國外扣繳,

Royalty, Withhold tax paying to non-resident tax-payer entity

GTX-MT-WW-70

服務費,支付國外扣繳,

Service fee, withhold tax paying to non-resident tax-payer Entity

GTX-MT-WW-80

利息,支付國外扣繳,

Service fee,withhold tax paying to non-resident tax-payer entity

CBM-MT-WW

跨區域據點管理

Cross-Border Management

***

CBM-MT-WW-10

歐美跨國企業如何管理海外據點

MNCs from EU or America, how to manage overseas operation base?

CBM-MT-WW-20

派駐人員;工作證申請;工作Visa 申請;居民證申請;住房補貼; 定期回國休假;個人所得稅

Expatriate; Work Permit, Visa, Resident Certificate; Housing Compensation; Periodically Back to Parent company; Individual Income Tax

CBM-MT-WW-30

跨區域拓展據點-發展步驟

Cross-Border Expansion-step by step

CBM-MT-WW-40

財務舞弊:支出簽核問題 VS 支出支付問題VS 網路銀行

舞弊問題: 幾個匿名舞弊例子

Financial Fraudulent

CBM-MT-WW-50

外國銀行帳戶VS 當地銀行帳戶VS 企業網銀

Foreign-owned Bank Account VS Local Bank Account VS Corporate Internet Banking

CBM-MT-WW-60

會計、出納人員安排;效忠母公司或地方總經理?

Expatriates on Accountant, Royal to Parent company or Local General Manager?

Contact us

If you are interested in any of the above-mentioned services,

please send an email with your requirements to HQ4sel@evershinecpa.com

Expect a response within 2 working days.

For investment structure relevant with multi-national tax planning and after-setup Accounting Cashiering Tax Payroll Services,

Please send an email to dalechen@evershinecpa.com & contact Dale Chen, Principal Partner/CPA in Taiwan+ China+ UK, & overall responsible for these arrangements.

linkedin address: Dale Chen Linkedin

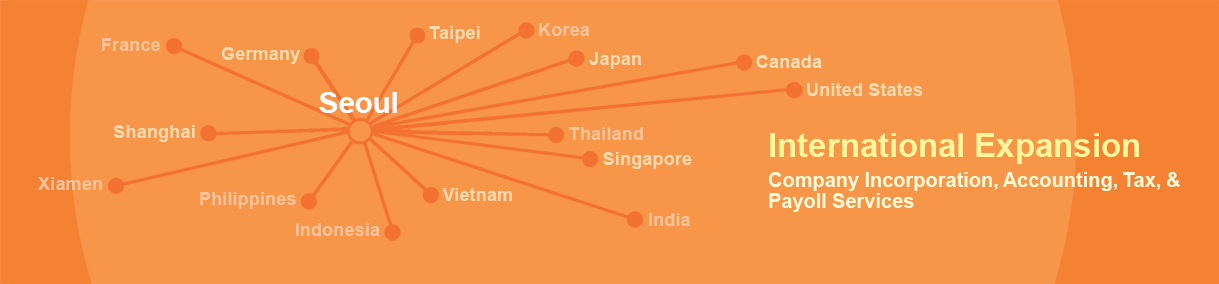

Evershine has its 100% owned office to provide you services in 10 cities:

Taipei, Beijing, Shanghai, Xiamen, San Francisco, Tokyo, Seoul, Hanoi, Singapore, New Delhi,

Besides, we have been providing our services by Both Evershine staff and local co-serving partners in below additional 18 cities:

Tianjin , Hsu Chang, Suzhou, Wuxi, Kansan, Hangzhou ,Nanjing, Guangzhou, Qing yuan, Shenzhen, Hong Kong, Kuala Lumpur , Hu chi minh city, Bangkok, Jakarta, Mumbai, Bangalore, Manila.