Taiwan Representative Office Setup sel2tw.ro

Send an email to HQ4sel@evershinecpa.com

Call us in working hours (Taipei and China Time)

Manager Jerry Chu, USA Graduate School Alumni and a well-English speaker

Mobile: +886-939-357-735

Tel No.: +886-2-2717-0515 ext. 103

Taiwan Temporary Employment Outsourcing become violating Labor Law 17-1.

Therefore we propose you setup your own Representative Office in Taiwan to replace it.

We also provide services on after-RO-setup payroll tax compliance , Expense Compliance check and arrangement of uploading online payment files to your internet-banking for your approval .

Taiwan Representative Office Setup sel2tw.ro

Regarding with Taiwan Representative Office Setup and after-setup services, please refer recent below dialogues between Evershine and Client.

Believe you will have complete and comprehensive understanding

Scenario

1. Figures

Joshua, a USA-based client’s HR Department Head

Caleb, a USA-based client’s CFO

Dale Chen, Evershine Principal Partner of Taiwan

Kerry Chen, Evershine Manager on Payroll Service

Jerry Chu, of Evershine Manager on Company Registration and Law services

2. Date and meeting method:

2020/2/06, during the period of outbreak of New Corona-virus.

Using internet conference meeting facility: GoToMeeting

Question 1 by Joshua:

We have interviewed 2 Taiwanese as our sales representative who will promote our products to Taiwan buyers.

If having any transaction, it will be between USA parent company and Taiwan buyers directly.

We actually need not to issue revenue invoices in Taiwan.

Therefore, we do not consider setting up a subsidiary in Taiwan.

Do Evershine Provide so-called Temporary Employment Outsourcing in Taiwan like PEO services in USA?

Answer 1 by Dale Chen

Not, now.

Actually, we had been providing Taiwan Employment outsourcing Services until 24 May 2019.

But, due to being effective of Articles 17.1 and 63.1 of the Labor Law of Taiwan, it prohibit the Dispatched Entities (real employer entities) to interview dispatchers prior to hiring and transfer to other Dispatching Entities to recruit them in order to avoid the employer’s responsibility.

In the event of occupational disasters of dispatchers, the Dispatched Entities should undertake the compensation and compensation responsibility jointly with the Dispatching Entities so as to make the labor rights and interests protection of the dispatchers more complete and comprehensive.

The point is that Dispatched Entities (real employer entities) cannot interview dispatchers prior to hiring. If violating prohibited behavior in this clause Article 17.1, the Dispatched Entity (real employer entity) might be fined between NTD 90, 000 to 450,000

We are not adopting this practice to serve client in Taiwan anymore.

Fortunately, the procedures and required documents for setting up your Representative Office in Taiwan become quicker, simpler and easier in last year.

we suggest you to set up your own Representative Office in Taiwan, then using it to recruit your own employees in Taiwan.

That will be legal practice and also simple, easy, time-saving, money-saving.

Question 2 by Caleb:

Because USA and Taiwan did not yet sign double taxation treaty, If we recruit local employee as sales representative in Taiwan for more than 6 months, will it have risk to be redeemed as “Permanent Establishment”?

Answer 2 by Dale Chen:

I agree what Caleb said.

Taiwan have been signed Double Taxation Agreement (DTA) with many countries whose representative office will be no risk to be redeemed as “Permanent Establishment”.

However USA did not sign DTA with Taiwan.

Therefore, legally, If USA-based company recruit Taiwan local employee for more than 6 months, setting up RO will be not totally enough although Taiwan tax bureau less use this clause in the past.

If USA-based Company want to be 100% safe, without tax risk, we suggest you set up Branch or subsidiary.

When you wire in money for covering office expenses, employees’ expenses and salary, we suggest you add 5%, and let Taiwan entity have revenue to be 105% of total Taiwan cost.

That means corporate income tax will be (5% of total Taiwan cost * 20% Corporate income tax rate).

But as I know, decision for setting up Branch or subsidiary must be approved by your BOD meeting. Besides, you need to assign a legal person to be Taiwan legal representative, it might be quite difficult.

You need to balance risk and efforts.

Question 3 by Caleb:

Although we will require setting up Representative Office in Taiwan now, but in the future, we maybe need Taiwan entity to issue revenue invoices.

Can you tell us how many different entity types?

How to judge what kinds of entities you need to register?

Answer 3 by Jerry Chu

In Taiwan, Foreigners’ entities include subsidiary, branch, and representative.

The difference Among Representative, Branch, Office Subsidiary.

(1) Representative office would not be a taxable entity and cannot issue GUI (Government United Invoice). It is not a legal entity.

Yes: Does it have a Tax ID?

No: Issuing Selling Invoices?

No: Is it a legal Entity?

* No need to do VAT filing and corporate income Tax filing.

*But still need to do Payroll withholding Tax compliance filing and Employee social benefit tax paying and filing.

(2) Branch would be a taxable entity that could issue GUI (Government United Invoice). However, it would not be a legal entity.

Yes: Does it have a Tax ID?

Yes: Issuing Selling Invoices?

No: Is it a legal Entity?

*If you have revenue incurred in Taiwan, Branch will be better because without dividend distribution tax.

(3) Subsidiary would be a taxable entity and would be a legal entity

Yes: Does it have a Tax ID?

Yes Issuing Selling Invoices?

Yes: Is it a legal Entity?

*If you need to assign expatriates to Taiwan, capital will be more than NTD 500,000.

Question 4 by Caleb:

Let us focus on setting up Representative now.

What are the procedures and required documents for setting up your Representative?

Answer 4 by Jerry Chu

1. Procedures (service scope)

1.1 Apply to the Department of Commerce, MOEA, for Rep. Office Registration (7 days)

1.2 Apply to the Taxation Bureau, MOF, for a tax code (3 days)

2. Required Documents

2.1 Certificate of Incorporation (including basic information such as the registered address, date of incorporation, authorized/issued capital and list of directors)

2.2 Power of Attorney for appointing the Representative of the Rep. Office

* We will provide you with the template for item 2.2

2.3 Power of Attorney for appointing a local CPA (Evershine CPAs Firm) to handle the application.

* We will provide you with the template for item 2.3

2.4 Representative’s Driver License and Passport copy

2.5 Taiwan-Registered Office Address documents:

2.5.1 Consent Letter signed by the Landlord

2.5.2 Copy of the property tax statement

2.5.3 Tenancy Agreement

Please be aware: The procedures and required documents for setting up your Representative Office in Taiwan become quicker, simpler and easier since 2018.

Question 5 by Joshua:

After setting up representative office in Taiwan, what kinds of services you provide us?

Answer 5 by Kerry Chen:

We have two big categorized services, for Taiwan Local Staff and for For your assignee Expatriates.

For Taiwan Local staff:

Service Coverage-for Taiwan Local Employees:

* Recruiting contract

* asking-leave arrangement and over-shift processing complied with Taiwan regulations

* Online Payroll Management System

* File for listing and delisting of Labor Insurance and Health Insurance

* Gross salary calculation based on fixed and non-fixed salary, Leave and Overtime

* Labor Insurance Charge paid by the company and employee

* Health insurance Charge paid by the company and employee

* Pension Fund Charge paid by the company and employee

* Withholding Tax

* Gross salary and net-cash salary

* Salary wire transferring services

* Delivering payment slip to each employee

* Accepting query from each employee.

* Annual accumulation salary income and withholding tax report to Tax Bureau.

* Year-end insurance premium certificate

* Severance pay application

* Semi-annual adjustment of insured caps and LPA caps.

* Laid-off arrangement complied with Taiwan regulations.

For your assignee Expatriates:

Service Coverage-for Foreign Expatriates:

* Recruiting contract

*Work Permit Application.

*ARC (Aliens Resident Certificate) Application

*Arranging Pick-up in Tao-Yuan International Airport

*Arranging hotel or renting residence

*Arranging Trading center or Office renting

*Arranging opening bank account

*Arranging Cell Phone or Car renting

*Payroll Compliance

*Arranging Employees’ expenditure

*Annual Personal Income Tax when an Expatriates stay in Taiwan over 183 Days in a year.

*Other local services

Question 6 by Caleb:

Except Payroll relevant services, Taiwan office need to pay office expenses and Employees’ relevant expenses. What kinds of services can Evershine provide us?

Answer 6 by Dale Chen:

Yes, we always call it as Expenses Compliance Check (ECC) Services.

According to our past 18 years experiences, if doing compliance check after paying-out like Traditional CPA firm did, that will be very difficult to revise them to be complied with local tax regulations once existing non-complied transaction.

As for non-complied transactions, for example, original receipt is not GUI (Government Unified Invoice), or need to be categorized as salary etc.

Therefore, we always do tax compliance check before paying out.

We will issue Compliance Check Report to you for your review before paying out

Besides we will undertake Maker Role to arrange paying-out to payee through your Internet Banking Account.

In summary four of our services are as follows:

1. Tax Compliance Check of Employees’ expenses before paying out.

2. Tax Compliance Check of office expenses before paying out.

3. Tax Compliance Check of purchasing fixed assets before paying out.

4. Generating and uploading online banking remittance files, undertaking Maker Role to arrange paying-out to payee through your Internet Banking Account, then you approve it to wire out. To payee directly. Nobody will touch cash.

Please be aware that:

We always use Evershine Cloud System to support our services

>>If Clients only have Wi-Fi environment, they access Evershine Cloud System free of Charge through given user name +password.

>>Anytime, anyplace can access.

>> Using Parent Company’s designated account code to easily integrate Daily Journal Entries

>>Every Employee can only see his/her own expenses, not allow seeing others.

>>Every Employee can trace status of his/her own expenses if under approving or under paying or already paid.

>> Your company’s internal control and signing procedures can be set inside

>> Evershine Cloud System will generate designated bank files (can be encrypted), upload directly to your online banking

>> Online banking, remote payment can be released directly to payee like employees and suppliers, nobody will touch cash to avoid fraudulent event.

>>Financial chop and personal name chop do not need to be handed over to local finances staff.

>> Client can centrally control the expenses cycle from the group headquarters.

> > Evershine Cloud system automatically generates: account payable account voucher and Journal Entries after payment

>> Cashier and accountant do not need to double Key-in

>>you can upload Journal Entries in Excel or CSV format for uploading your company ERP.

>>If your company has a software engineer, you can use API or Web service and other methods to integrate with your company’s ERP in time.

If you want to have more information, please don’t hesitate to contact us.

Contact Us

If you are interested in our services, please send an email to HQ4sel@evershinecpa.com. You will receive an auto-reply with necessary details about Taiwan. We will respond to you in 1-2 working days.

You may also call in working hours (Taipei and China Time):

Manager Jerry Chu, USA Graduate School Alumni and a well-English speaker

Mobile: +886-939-357-735

Tel No.: +886-2-2717-0515 ext. 103

Additional Information

Taipei Evershine CPAs Firm

6th Floor, 378 Chang Chun Rd.,Zhongshan Dist., Taipei City, Taiwan R.O.C.

Near MRT Nanjing Fuxing Station

Principal Partner :

Dale C.C. Chen

CPA in Taiwan+China+UK/ MBA+DBA/ Patent Attorney in Taiwan

Mobile: +86-139-1048-6278

in China ;

Mobile:+886-933920199

in Taipei

Wechat ID: evershiinecpa ;

Line ID:evershinecpa

skype:daleccchen ;

Linking Address: Dale Chen Linkedin

Evershine Global Service Sites for Reference:

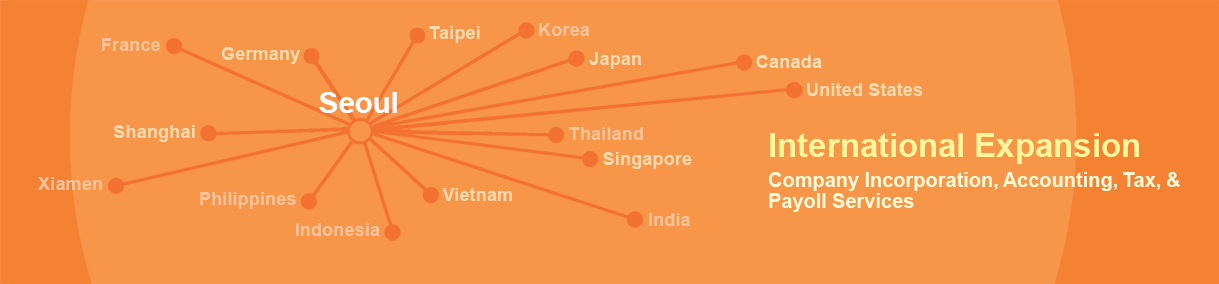

Evershine’s 100 per cent affiliates:

Taipei Evershine. Tpe, Shanghai Yonghui. Sha, Beijing Yonghui. Pek, xiamen yonghui. Xmn, Evershine, San Francisco. Sfo, Tokyo Evershine. Del, Seoul Evershine. Sel, Hanoi Evershine. Han, Bangkok Evershine. Bkk, Singapore Evershine. Sin, New Delhi Evershine. Del, Manila Evershine. Mnl, Berlin Evershine. Ber, London Evershine. lon

Other Already-providing-service Cities:

Kaohsiung, Hong Kong, Shenzhen, Dongguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin, Sydney, Australia, Kuala Lumpur, India 4 cities, Vietnam, Jakarta, Manila, Turkey, Istanbul, Germany 4cities, Paris, Amsterdam

Potential Serviceable Cities:

For any other city you wish to visit, please refer to the following two websites,

IAPA Find out Member Firm of IAPA

and LEA Find out Member Firm of LEA

This is the membership of Evershine’s international accounting firm in each city

About 900 member offices, 38,000 people, 450 cities

We can arrange services for your company’s overseas subsidiaries as long as you are in these cities

Please contact us by email at HQ4sel@evershinecpa.com

Other Related Services Links:

>> Other Services in Taiwan

>> Company Registration in Other Cities of China